Current Energy Sector News as of October 24, 2025: Oil and Gas Prices, OPEC+ Decisions, Renewable Energy Developments, Energy Security, and Sanction Policies

As of October 24, 2025, the global fuel and energy sector is facing a harsh geopolitical confrontation amid relative stability in the raw material markets. The sanctions standoff continues: the West is expanding restrictions - the European Union has approved a phased withdrawal from Russian gas imports by 2026 and is discussing a complete embargo on oil supplies by 2028. Furthermore, under pressure from partners, India has announced its readiness to gradually reduce purchases of Russian oil – a move that could redistribute global energy flows.

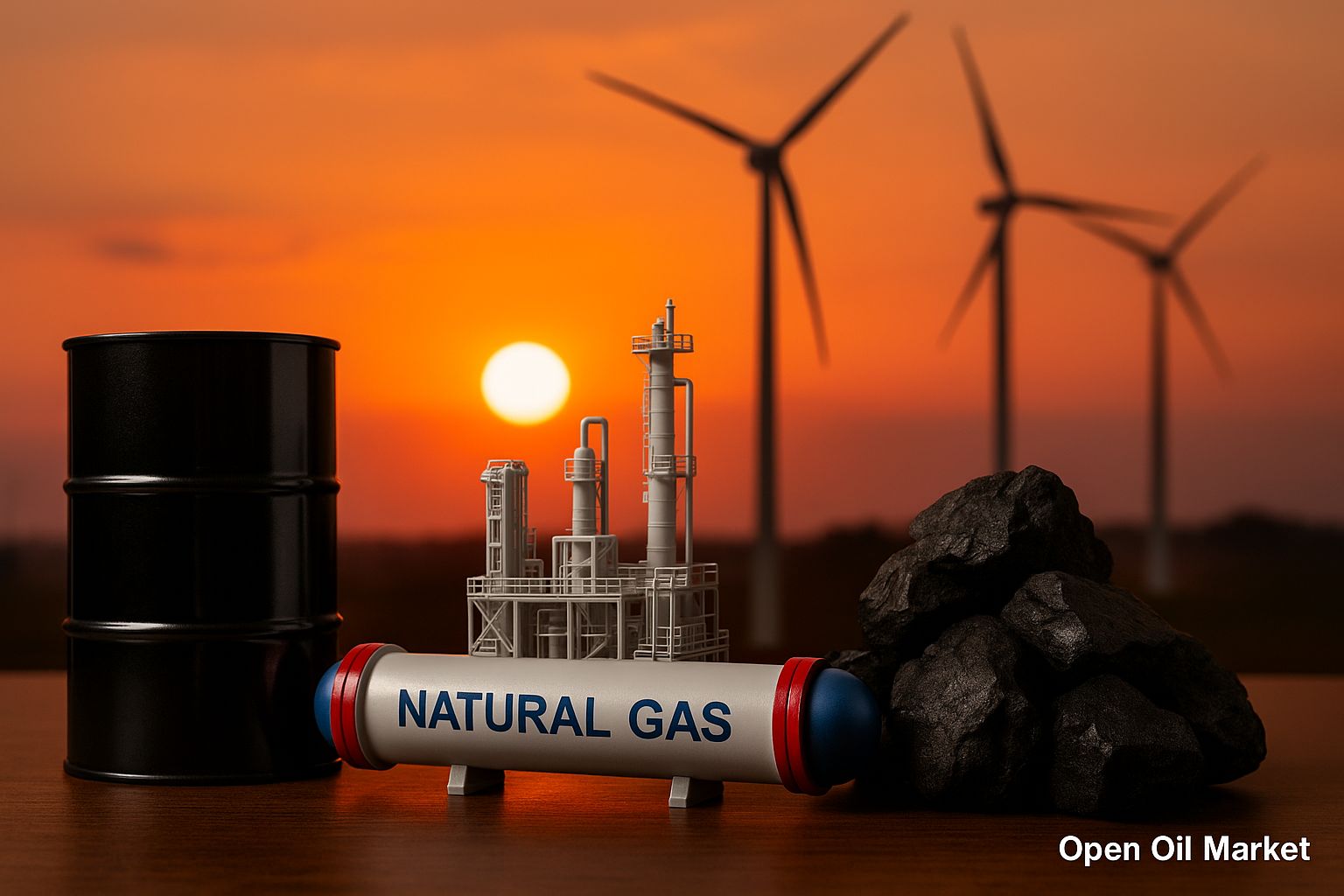

At the same time, the raw material markets demonstrate a moderately stable trajectory. Oil prices remain near multi-month lows due to an anticipated supply surplus by the end of the year: Brent crude holds above $60 per barrel (around $62), while WTI trades at $57–59 – approximately 10% cheaper than a month ago. The European gas market is heading into winter with record fuel reserves (over 95% storage capacity), ensuring a high level of energy security and keeping prices under control. The global energy transition is gaining momentum: investments in renewable energy are breaking records, although traditional resources – oil, gas, and coal – still underpin energy supply. Below is a summary of key events and trends in the energy sector as of the current date.

Oil Market: Oversupply and Hesitant Price Growth

Global oil prices have remained low since the summer, although there has been a slight recovery in prices in recent days. Following a brief rally in September, the market once again headed downward – Brent dropped to $60 per barrel. Currently, prices have rebounded slightly from their lows: Brent is trading around $62. Fundamental factors indicate an strengthening oversupply; however, geopolitical tensions prevent prices from falling deeper, maintaining a slight risk premium.

- Oil Oversupply. The OPEC+ alliance is steadily increasing production (approximately +130,000 barrels per day from November), while non-OPEC countries (such as the U.S., Brazil, etc.) have seen output nearing record levels. Meanwhile, global demand is growing slowly: the IEA forecasts an increase of only ~0.7 million barrels per day in 2025 (compared to >2 million in 2023) due to slowing economies and the effects of previous high prices. As a result, global oil inventories are rising, increasing pressure on prices.

- Sanctions and Flow Redistribution. The ongoing sanctions pressure on Russia creates uncertainty in the market. A complete ban on purchasing Russian oil and stricter controls over "shadow" exports are being discussed. Key importer India may reduce imports of Russian crude under external pressure. The loss of the Indian market would intensify the pressure on Russian exports, but the global market as a whole would be able to adapt, redirecting the freed volumes to other buyers and maintaining balance in supply.

Thus, the oil market remains close to a surplus situation. Brent and WTI prices fluctuate within a narrow range, receiving no impetus for either growth or decline. Oil companies and investors are adopting cautious strategies considering the oversupply and risk of external shocks.

Gas Market: Record Reserves and Export Reorientation

The gas market is entering winter in a favorable state. European countries have accumulated record amounts of gas (over 95% storage capacity), ensuring a high level of energy security for the coming months. Gas prices in the EU are maintained at moderate levels – substantially lower than crisis levels in 2022; only extreme cold can trigger a brief spike. The EU is systematically reducing its dependence on Russian gas and aims to completely stop imports by 2026. Russia, for its part, is redirecting export flows to other markets, compensating for the decline in European supplies by increasing fuel sales in Asia and boosting liquefied natural gas exports.

- Europe's Confidence. Full storages and reduced consumption create a solid gas reserve for the winter. The EU has increased LNG purchases from the U.S., Qatar, and other countries, diversifying fuel sources and reducing dependence on supplies from Russia.

- Flow Shift to the East. Russian pipeline gas exports to Europe have decreased to a minimum and are being replaced by global LNG supplies. Simultaneously, Gazprom is increasing exports to China (volumes through the Power of Siberia pipeline are nearing maximum) and developing new routes such as Power of Siberia 2. Russia is also expanding LNG production to direct more gas to friendly markets in exchange for lost European demand.

Consequently, the gas sector enters winter without significant disruptions. High reserves and diversified supplies allow for the expectation that Europe can avoid fuel shortages even in colder weather conditions. For Russia, shifting focus to Asian markets partially offsets the loss of European demand; however, fully restructuring the gas industry will require time and investments.

Power Sector: Record Consumption and Network Modernization

Global electricity consumption in 2025 is expected to reach an all-time high (over 30,000 TWh). Leading economies – the U.S. and China – are generating record amounts of electricity, while demand in many developing countries in Asia, Africa, and the Middle East is rapidly rising due to industrialization and population growth. To reliably supply this load, significant investments are required to modernize power grids and energy storage systems. Countries around the world are already strengthening infrastructure and integrating new capacities (including renewables) into energy systems to avoid power supply interruptions.

Renewable Energy: Investment Boom and Growth Challenges

The renewable sector continues to gain traction, reinforcing the global "green" transition trend. In 2025, a record number of new solar and wind power plants are expected to be commissioned, supported by large-scale government incentives in major economies. Simultaneously, the rapid growth of renewables is accompanied by a number of challenges, while traditional energy resources still remain the backbone of global energy supply.

- Records in Clean Energy. Approximately 30% of global electricity in 2025 is expected to be generated from renewable sources – a record share. For the first time, the share of solar and wind generation exceeds that of coal. This situation marks an important milestone for the industry and confirms the acceleration of the "green" transition.

- Government Support. Governments of leading economies are promoting the development of renewables. In Europe, stricter climate goals are being introduced, requiring the accelerated launch of clean capacities and expanded emissions trading. In the U.S., extensive subsidy programs and tax incentives for green energy are in place. These measures lower industry costs and attract investment, speeding up the transition to clean energy.

- Growth Challenges. The renewable boom is accompanied by difficulties. High demand for equipment and raw materials is raising component costs, while integrating intermittent generation requires new energy storage solutions and backup capacities for grid balancing. Solving these challenges is crucial to maintaining high rates of "green" transition without compromising the reliability of energy supply.

Despite the challenges, renewable energy is attracting massive investments and has become an integral part of the global energy balance. As technologies become cheaper, the share of clean energy is expected to increase, while innovations (such as more efficient batteries and hydrogen technologies) open new possibilities. For investors, the renewable sector remains one of the most dynamic; however, it is essential to consider the associated risks – from regulatory to infrastructure-related – when implementing projects.

Coal: Demand in Asia Amid Global Phase-Out

Despite the climate agenda, countries in Asia continue to actively utilize coal for electricity generation, maintaining high demand for this fuel. Meanwhile, developed states are accelerating the phase-out of coal and replacing it with more environmentally friendly energy sources.

Russian Fuel Market: Stabilization and Control

In the autumn of 2025, the situation in Russia's internal oil products market has significantly improved after the critical crisis in September. The government swiftly implemented measures, and by mid-October, the fuel deficit in most regions was eliminated: wholesale prices for gasoline and diesel decreased from their peaks, and independent gas stations resumed operations nationwide. Nevertheless, disruptions are still felt in remote areas, prompting authorities to maintain control and extend government regulations in the fuel market.

To stabilize the market, the ban on gasoline exports has been extended (with rigid restrictions on diesel exports), and subsidies for refineries supplying the domestic market have been maintained. Additionally, price supervision of gas stations has been intensified without direct administrative intervention.

The measures taken have allowed for a swift recovery in production and supply to gas stations to pre-crisis levels. Authorities hope to get through the coming winter without supply disruptions, maintaining a heightened state of readiness for potential new challenges. To prevent similar crises in the future, plans are in place to modernize the fuel storage and delivery systems and to increase the depth of oil refining domestically.

Conclusions and Forecast

The energy sector as a whole demonstrates resilience, but significant challenges lie ahead – particularly during the winter period. Nonetheless, accumulated reserves and corporate adaptation instill hope that the global energy sector will navigate this phase without major disruptions.